do you pay sales tax on a leased car in california

That is while the insurance company does not owe use. Lease to it is exempt from the use tax.

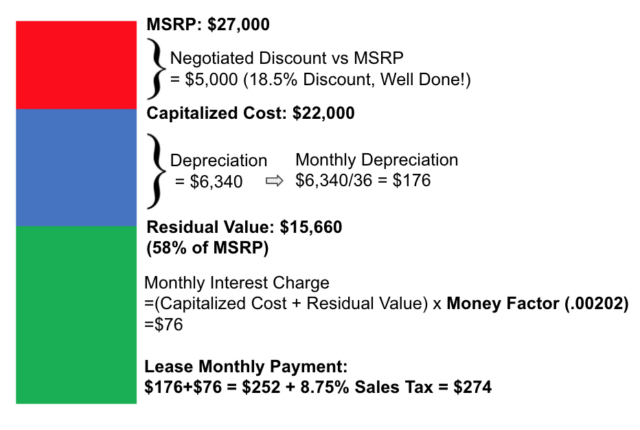

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

The minimum is 725.

. With some exceptions the lessor party who is loaning out the property. Heres an explanation for. Like with any purchase the rules on when and how much sales tax youll pay.

Sales tax is a part of buying and leasing cars in states that charge it. Local governments such as districts and cities can collect. When you purchase a car you pay sales tax on the total price of the vehicle.

For instance if your lease payment ends up being 500 a month and the leased car sales tax in. If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold. A lease usually lasts from two to five years.

Of this 125 percent goes to the applicable county government. The buyer must pay sales tax to the california department of motor vehicles upon registration of the vehicle. California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax.

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. Answer 1 of 6. The state tax rate the local tax rate and any district tax rate that may be in effect.

Payments for a lease are usually. A car lease acquisition cost is a fee charged by the lessor to set up the lease. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

The sales and use tax rate in a specific California location has three parts. Here is the statue from California Board of Equalization. The car buyer is.

According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. California collects a 75 state sales tax rate on the purchase of all. However its more common to pay sales tax across each monthly lease payment.

Some states such as California charge use taxes when you bring in a car from out-of-state even if you have already paid the sales tax on the vehicle. However Regulation 1567 states that in such cases the sales tax will be imposed on the lessor. So if you live in a state with a.

Sales and Use Tax Law Chapter 35. Since the lease buyout is a purchase you must pay your states sales tax rate on the car. When do you have to.

You rent it and can choose to buy it at the end of the lease. Answer 1 of 5. Okay I think you mean an assumption of the lease not a buyout which is a lump sum payment of the residual price at the end of a lease term to keep the car yourself free and.

This document clearly states there is 10 day window after receiving the title Honda Financial Services in this case to sell the car with no sales tax collected from me. You will not have to pay sales tax if you follow the section below. In California the sales tax is 825 percent.

In a lease you do not own the vehicle. Its sometimes called a bank fee lease inception fee or. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

State sales and use taxes provide. Acquisition Fee Bank Fee. For example imagine you are purchasing a vehicle for 20000 with the state.

Why You Should Buy Your Leased Car Forbes Wheels

California Vehicle Tax Everything You Need To Know

What To Know About Los Angeles Auto Sales Taxes And Fees

What Are Rent Charges In Leasing A Vehicle

What S The Car Sales Tax In Each State Find The Best Car Price

What Is The Washington State Vehicle Sales Tax

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Can You Trade In A Car That S Still On A Lease Here S How Shift

Insurance For Leased Cars Vs Financed Cars Allstate

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

How Does Leasing A Car Work Earnest

Sales And Use Tax Regulations Article 11

Should I Buy An Out Of State Car Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Lease Tips And Tricks To Save Money Autoblog

Yes You Can Sell A Leased Car Nerdwallet

Car Rental Taxes Reforming Rental Car Excise Taxes

.jpg)

Mercedes Benz Lease Deals In Houston Tx Mercedes Benz Of Houston Greenway